- Address

- Hash

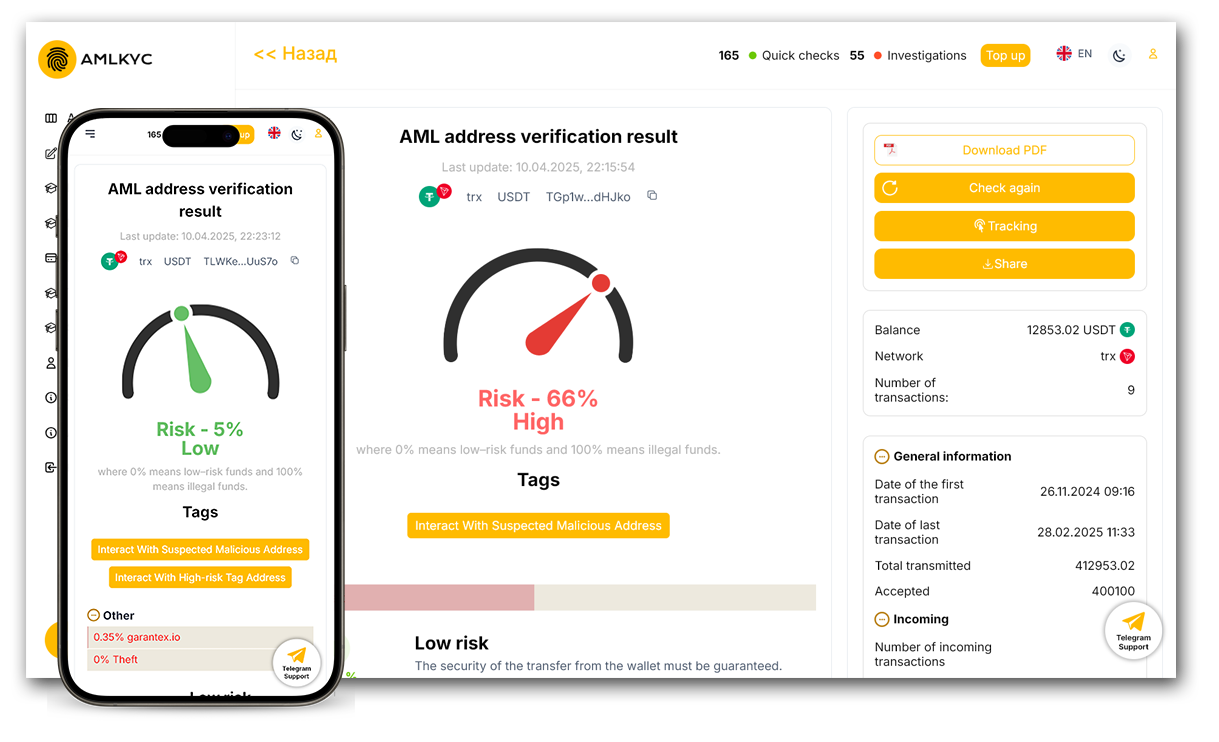

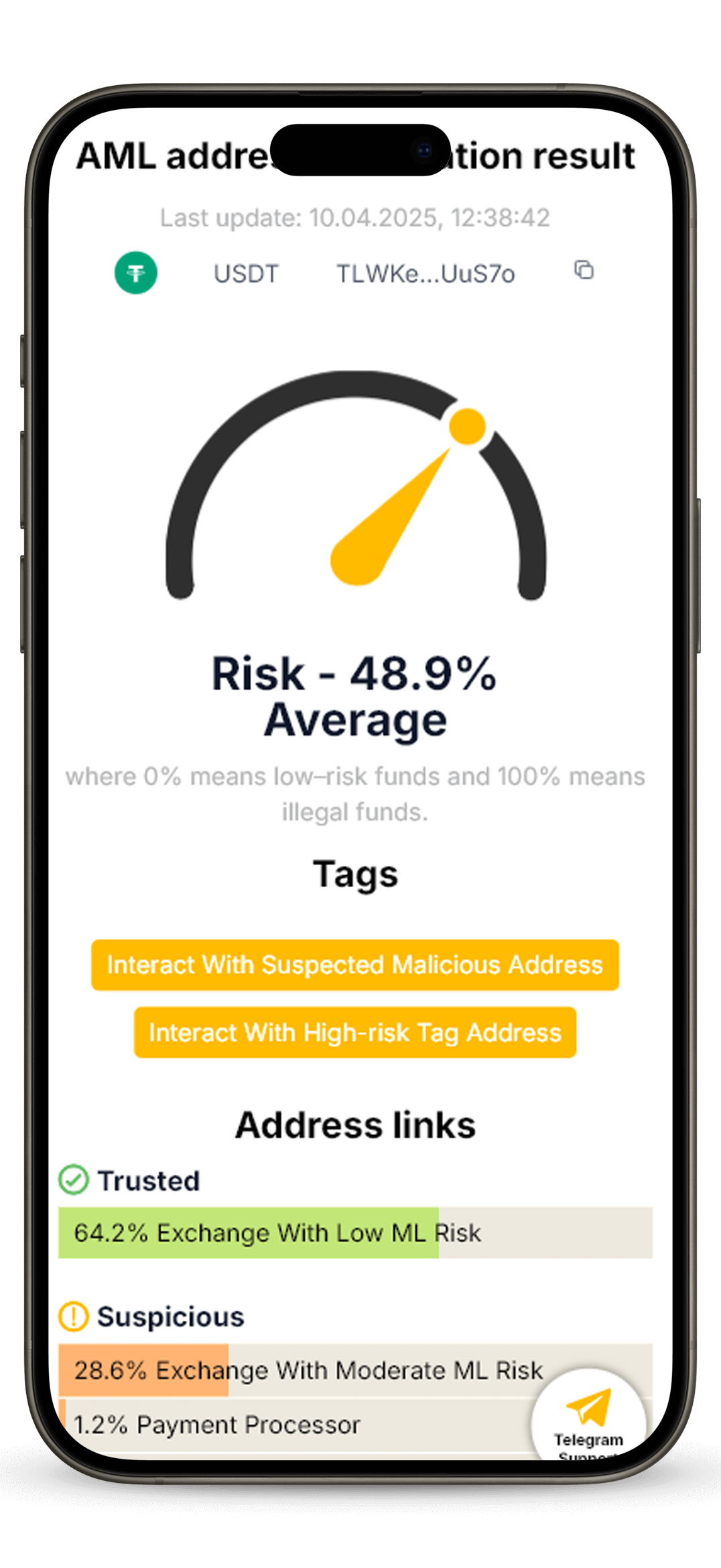

Risk-scoring of transactions and wallets

- For clients - from 0.65$

- For business - from 0.17$

AML features

More detailed

More detailed

PDF report

Upon completion of the verification, please download a PDF file containing the verification report and full information about the wallet.

Bonus

Check your customers for free using the AMLKYC database, which is regularly updated

40 networks

Supports: 40 BTC, ETH, LTC, ETC, BCH, XRP, ZEC, ERC-20 and TRC-20 networks, as well as DOGE, ADA, SOL and others

Verification accuracy

The verification is carried out with an accuracy of 99.5%. The accuracy of our risk assessment reaches 99.5%, based on data from three independent sources

API

Perform AML checks using the API and protect yourself and your business from risks

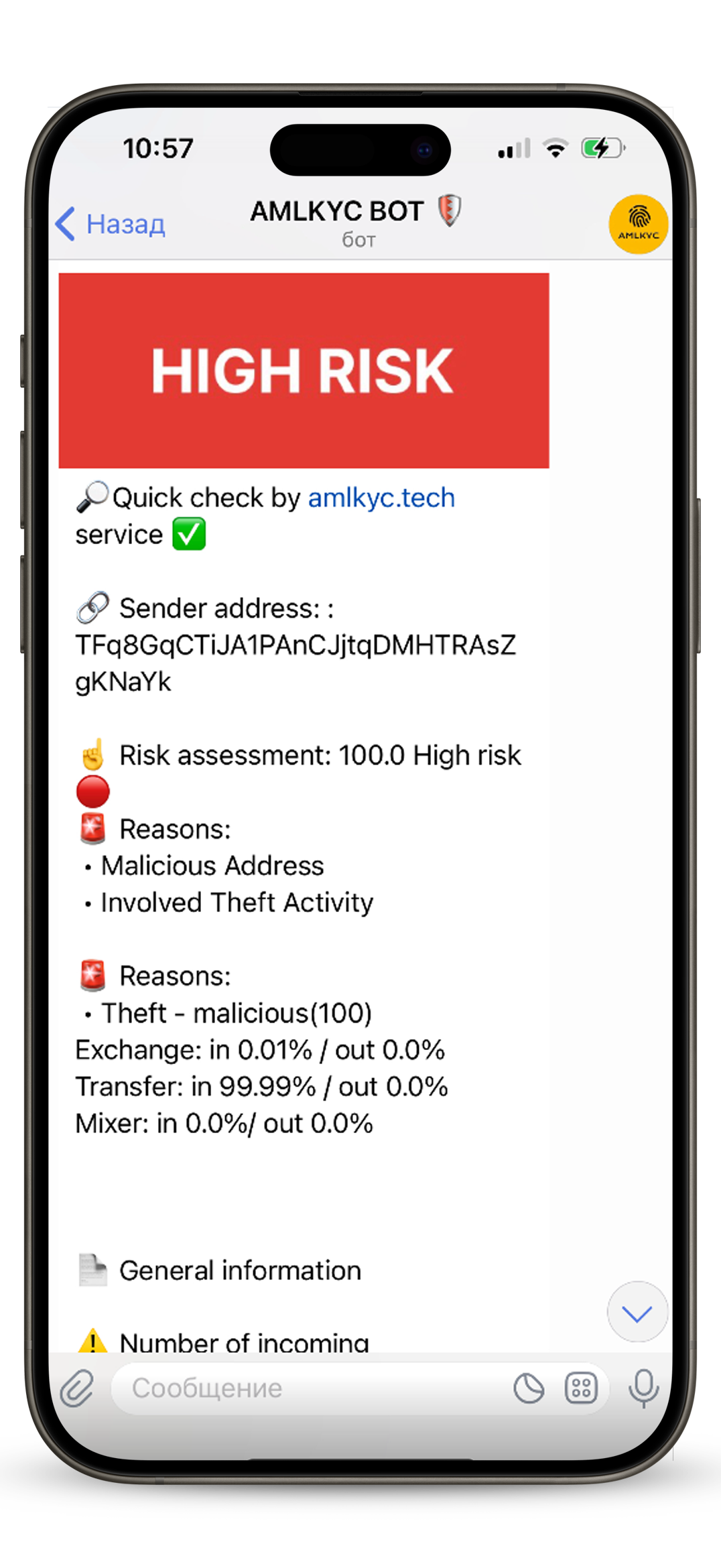

Antifraud

A powerful tool for fraud prevention and countering criminal activity using cryptocurrencies

Crypto Chart

Learn more

Checking your wallet

Checking the wallet in real time. We are checking the wallet`s sanctions and restrictions

AML Verification

In accordance with the requirements of the Law on the Prevention of Money Laundering and the Financing of Terrorism, we verify the funds and their origin.

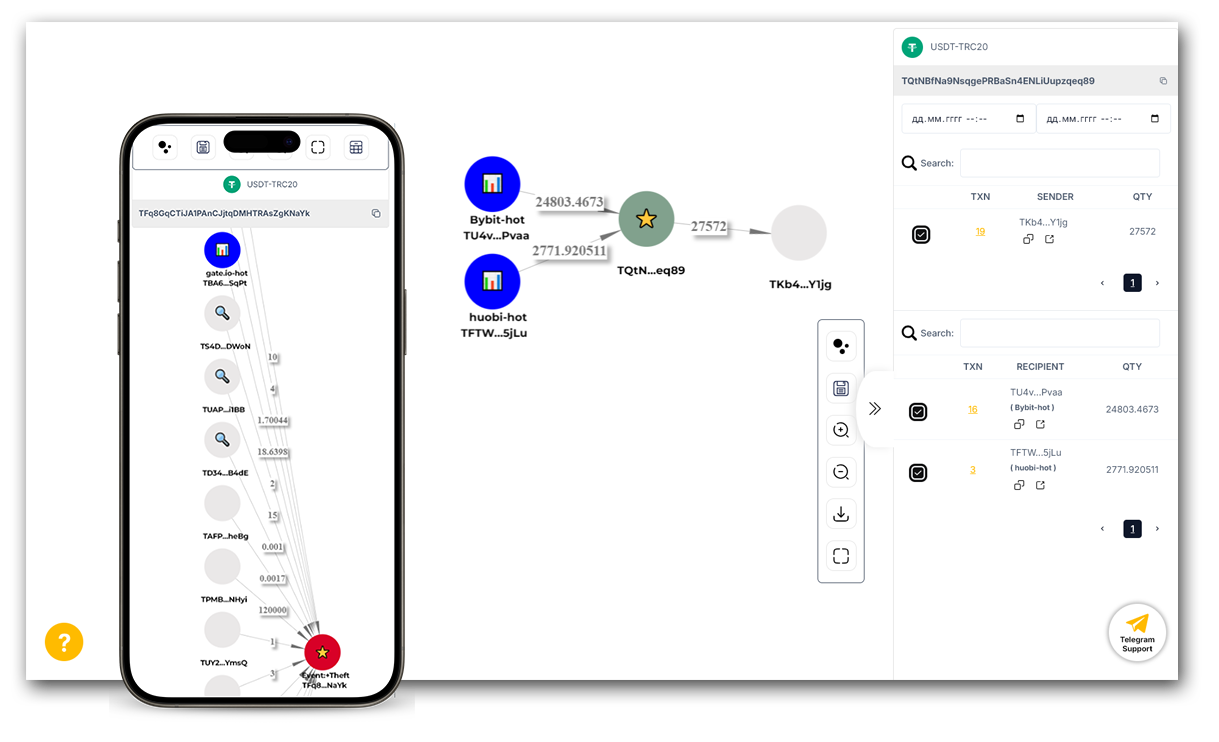

Investigation

We are building chains and connections for moving funds to exchanges and other platforms

Antifraud

The application will help you to block your funds online and return them back

300 Sources

The system supports more than 300 sources for verification and monitoring

Multilingualism

Supports more than 7 languages for user convenience

AMLKYCBot©️

Start Telegram BOT

Start Telegram BOT

Verified blocks

Safety is in your hands

-

Round-the-clock monitoring

Monitoring RPC nodes is the most affordable way to monitor your crypto ecosystem.

-

Multiple networks

Get monitoring of RPC nodes on more than 113 of the most popular blockchains.

-

Access for public services

Get access to the test network of RPC nodes to start monitoring transfers.

-

Block Researchers

Always be aware of your transactions.

-

Web Socket connections

The most advanced and secure technologies are used for your crypto business.

-

A dedicated node

Your fully managed private RPC node for cryptocurrency monitoring.

We are certified

AMLKYC is certified according to ISO 9001

AMLKYC is certified according to ISO 27001

AMLKYC is certified according to the PCIDSS standard

AMLKYC is certified according to the MICA standard

AMLKYC is certified according to the FATF standard

AMLKYC is certified according to the GDPR standard